1. It is difficult for a single strategy to adapt to the complexity of market style.

In the past year, the A-share market has experienced different styles of switching and industry rotation, and recently after a substantial adjustment of the index, the market has gradually entered the stage of differentiation of industries, plates and individual stocks. Generally speaking, the trend of the equity market is often affected by many factors, and the market ups and downs are accompanied by the switching of the core driving factors. from the perspective of the rate of return of the market style factor, we can see the complexity and reciprocity of the market.

The investment strategy of a single manager can often obtain excess returns in the market that suits his investment style, but when the market style or drivers are switched, the strategy of a single manager is often easy to fall short. At the same time, the performance of a single strategy portfolio tends to fluctuate greatly, so it is difficult to achieve stable returns for a long time in the market with rapidly changing environment. Take the bullish growth strategy as an example, which significantly outperformed the market in the second half of 14 years, but made excess returns at the beginning of 15 years. In different time points and different market environments, choosing the managers who are most suitable for the current market environment and giving full play to their management ability is a more effective way to obtain long-term stability α.

2. multiple managers give full play to the advantages of strategic combination.

In the current market environment, it is difficult to require managers to have all-round market management ability. Through the way of portfolio management, giving full play to the multiple strategic advantages of multiple managers is the best choice for equity investment management.

Through the way of portfolio management, MOM management gives full play to the advantages of multiple managers, strategies and styles. On the one hand, it actively grasps investment opportunities in different market environments, on the other hand, it also reduces portfolio volatility, effectively improves risk-adjusted income indicators, and creates balanced excess performance.

MOM management model is an asset management model adopted by large international asset management institutions and social security funds. Through the combination of top-down asset allocation and bottom-up selection of managers, the two-tier allocation of investment portfolio and investment managers can achieve the effect of multiple styles, strategies and managers. Invest in a MOM portfolio to achieve multiple investment strategies, multiple markets, multiple types of assets dispersion, achieve multiple levels of risk diversification, taking into account the satisfaction of a variety of needs.

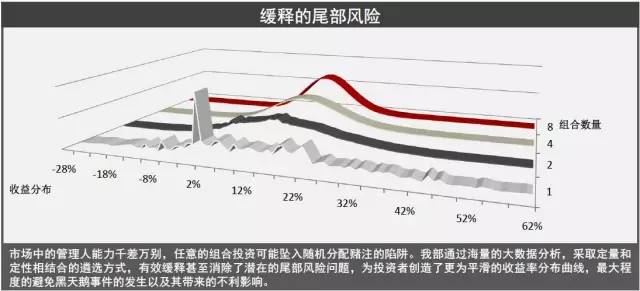

Through the way of combination, multiple managers or multiple strategic accounts are put into a secondary investment portfolio to form a more balanced risk-adjusted return that can not be provided by a single manager or strategy, thus moving the effective boundary to the upper left as a whole. to form a better investment effect. At the same time, multi-managers and multi-strategies effectively slow-release or even eliminate the potential tail risk problems, create a smoother yield distribution curve for investors, and avoid the occurrence of the black swan event and its adverse effects to the greatest extent.